Your Deal is Almost Done...Then Comes Due Diligence!

Having an 'Expression of Interest' or 'Letter of Intent' signed by both the buyer and the seller can be a very good feeling. Everything can seem as though it is moving along just fine, but the due diligence process must still be completed.

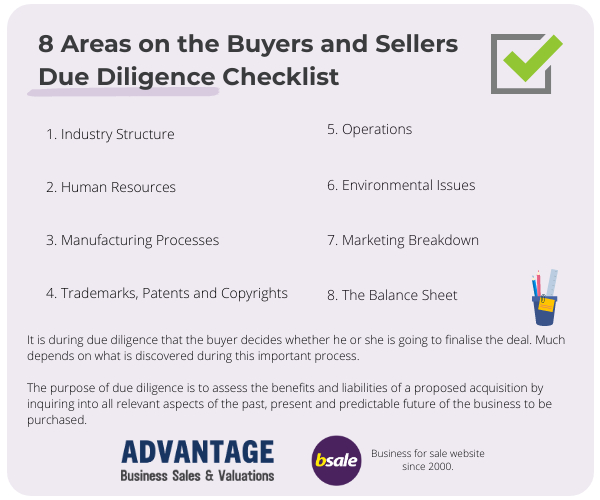

It is during due diligence that the buyer decides whether he or she is going to finalise the deal. Much depends on what is discovered during this important process.

The purpose of due diligence is to assess the benefits and liabilities of a proposed acquisition by inquiring into all relevant aspects of the past, present and predictable future of the business to be purchased.

Buyers and Sellers Checklist

Let’s look at some of the main items that both buyers and sellers should have on their respective checklists.

Industry Structure

You should determine the percentage of sales by product line. Additionally, take the time to review pricing policies, product warranties and check against industry guidelines.

Human Resource

Review your key people and determine what kind of employee turnover is likely.

Manufacturing

If your business is involved in manufacturing, then every aspect of the manufacturing process must be evaluated.

Is the facility efficient? What is the equipment worth? Who are the key suppliers?

How reliable will those suppliers be in the future?

Trademarks, Patents and Copyrights

Trademarks, patents, and copyrights are intangible assets and it is important to know if those assets will be transferred.

Intangible assets can be the key assets of a business.

The buyer and seller need to be prepared for due diligence

Operations

Operations are key, so you’ll want to review all current financial statements and compare those statements to the budget. You’ll also want to check all incoming sales and at the same time analyze both the backlog and the prospects for future sales.

Environmental Issues

Environmental issues are often overlooked, but they can be very problematic. Issues such as lead paint and asbestos, as well as ground and water contamination, can all lead to time-consuming and costly fixes.

Marketing

Have a list of major customers ready. You’ll want to have a sales breakdown by region as well. If possible, you’ll want to compare your company’s market share with that of the competition.

The Balance Sheet

Accounts receivable will want to check for who is paying and who isn’t. If there is bad debt, it is vital to find that debt.

Inventory should also be checked for work-in-progress as well as finished goods.

Finally, when buying or selling a business, it is vital that you understand what is for sale, what is not for sale and what is included, whether it’s machinery or intangible assets such as intellectual property.

Tags: selling coaching small business entrepreneurs

About the author

Dione Mauric

A co-founder of Advantage Business Sales and Valuations, Dione Mauric has a unique ability to create successful outcomes for her clients - ...