Why are 386,392 Businesses Closing and not Selling?

Why are 386,392 businesses closing and not selling?

With over 2.5 million businesses currently trading in Australia, what can we learn from exit rates and the number of businesses currently for sale? When you take into account the various business for sale platforms, listing numbers range from 11,000 - 18,000 and include a combination of businesses, franchises and opportunities.

There were 386,392 businesses that closed in the 2023 financial year, according to the Australian Bureau of Statistics (ABS). Compared to the 14,181 businesses for sale on Bsale there is roughly 3.67% of this exit market that is for sale to the public at the moment, what does this mean for business owners?

There is a huge discrepancy between exit rates and businesses listed for sale. Businesses will come and go from business for sale platforms, some businesses are listed for 3 months, others over 12 months. Some are opportunities or franchises, some are online or distribution opportunities. Due to the nature of business sales, not all information about the business is disclosed.

When we take a look over the listings in 2023, we stop to ask, what happened to the other roughly 80-90% of businesses that closed and don't appear to have been listed for sale?

The reasons behind the 386,392 business closures can be multifaceted. While financial hardship and insolvency are common factors, other reasons like owner retirement without succession plans, shifts in market trends, and business failure, also play a significant role.

If we dive a little deeper into the ABS statistics, we may get a clearer picture.

1. Business Turnover

According to the ABS, in 2023 91.9% of businesses had a turnover of less than $2 million, and 24.7% had a turnover of less than $50,000.

Turnover of less than $2 million

The fact that 91.9% of businesses have a turnover of less than $2 million highlights the predominance of small businesses in the Australian economy. These businesses, which form the backbone of the economy, range from micro-enterprises to more established small-scale operations.

These are the types of businesses we often see coming for sale on Bsale. They have an asset that is transferable to a new owner. Larger businesses usually dont come on business for sale platforms unless they include a freehold component, or are being handled by top-teir business brokers.

When it comes time to sell these types of businesses, the owners need to be very prepared to sell and transfer ownership.

The average value of businesses on Bsale is roughly $635,000, which mainly represents businesses in this category. Remember a sale price and turnover are all completely different measures of a business's success. A business's value is usually based on its profitability, not turnover. But it's safe to say that most businesses on Bsale are in this 91.9% of businesses.

Turnover of less than $50,000

The 24.7% of businesses with turnover under $50,000 are likely to be micro-businesses or sole proprietorships. This segment might include part-time businesses, startups in their infancy, or businesses operating in niche markets with limited sales volumes.

These types of businesses are hard to sell because they dont have much transferable value, and the success of the business is often tied to the business owner so once they leave, there is very little value left in the business.

So that is roughly 639,698 (24.7%) of businesses operating, that probably aren't sellable when the time comes to exit because of their low turnover.

2. Structure

Whether a business is operated as a sole-trader, partnership, company or trust plays a huge role when the time comes to sell a business. Buyers want to ensure a smooth transition of ownership and a clear picture of what they are actually purchasing. Sole-trader and partnership type structures tend to have several blurred lines between the business owners' personal finances and business finances.

It is often the case, that these types of businesses are also heavily reliant on the business owner so when it is time to sell the business, it is hard to guarantee future success once the owner is removed. Look at businesses like trade services, beauty salons, professional services etc. How are they structured and how reliant are they on the business owners' reputation?

The bar graph above compares the total exits among Sole Proprietors, Partnerships, and Companies in 2023.

Sole Traders + Partnerships

There were 784,744 sole traders as it June 30, 2023, showing a 23.2% exit rate (185,513) businesses that were closed. Due to the nature of sole-traders and partnerships its hard to tell if they just closed, or they sold the assets to another business and then closed. However, it does account for a whooping 48% of the entire exit rate for 2023.

This relatively high exit rate could reflect several factors inherent in running a sole proprietorship, such as the challenges of managing a business independently, market competitiveness, economic pressures and the inability to have a business to actually sell.

Partnerships fared a bit better with 27,322 exits accounting for 11.8%.

Combined these two structures accounted for 212,835 businesses closure in 2023, roughly 55% of all exits. Some of these may have sold the assets and then closed the business - so the picture isnt clear.

Companies

There is a definite increase in the growth of companies in 2023, it is proving to becoming the most popular structure.

“In 2022-23 total companies had the largest net growth of any type of legal organization, increasing by 42,246 businesses, or 4.0% to 1,094,465 total. This was driven by births of total companies, with 137,164 entries.” ABS Data

Whist there was 124,902 companies closed in the 2023 financial year, the reasoning would likely come down to a number of operational and financial factors, and not solely due to business structure.

3. Industry

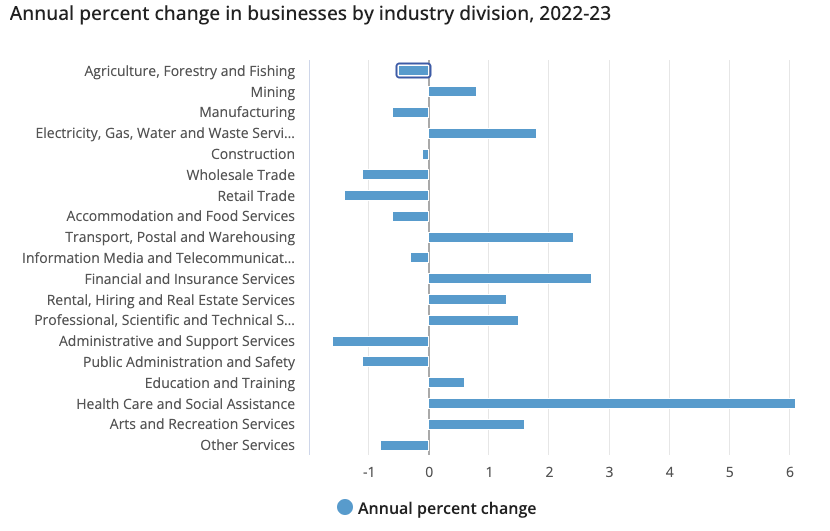

The economy can affect certain industries and result in businesses needed to close. The ability to sell the business may be difficult as the industry as a whole is struggling. It can also be a result of a change in time with the advance of technology. If we take a look at the total entry vs exit rates for different industries you can see that certain industries are out-performing others and this is an important consideration when looking to buy or sell a business.

Top Trending Industries

- Health Care and Social Assistance: This sector experienced a substantial growth of 6.1%, bringing the total number of businesses in this industry to 185,260. This increase underscores the expanding demand for health and social services.

- Financial and Insurance Services: This industry saw a growth of 2.7%, resulting in a total of 123,266 businesses. This rise reflects the growing complexity and need for financial and insurance-related services in the economy.

- Transport, Postal and Warehousing: Marking a 2.4% increase, this sector grew to encompass 218,662 businesses. The growth in this area highlights the increasing importance of logistics and delivery services, likely fueled by the growth in e-commerce and the need for efficient supply chain solutions.

ABS Data on entry and exit rates for business industries, 2023.

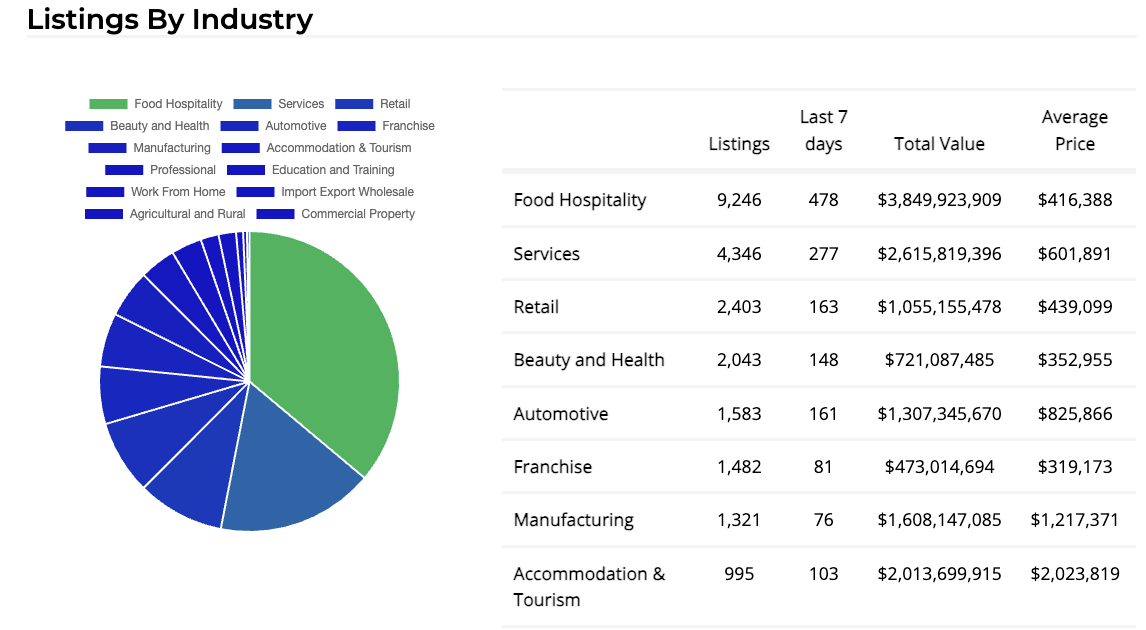

To give an idea of how industries are tracking on Bsale, here are the top 8 industries by number of listings. All industries can be found on the Bsale Market Insights.

So What Does All This Tell us About Business Sales?

I think the most remarkable statistic is that 212,835 sole-trader and partnership-structured businesses closed in 2023, roughly 55% of all exits. Whilst it is hard to sell what actually happened with these closures, whether they did sell the assets and then closed the business, or they closed due to the inability to operate.

Sole-traders are difficult to sell, because legally you can't actually sell the business, you can only sell the assets and transfer them to the new owner (or business). This may create barriers for buyers wanting to purchase the business. It also creates some limitations on how transferrable the business actually is, as these types of businesses are usually heavily reliant on the current business owners reputation and the business may struggle afterwards.

It is hard to get a clear picture, but business owners and buyers need to be aware of this. If you plan to exit your business, you need to have it ready for sale. This could mean looking at your structure and plans for ownership transfer. Sole-Trader and Partnership businesses do sell all the time, but a lot also seem to be closing.

If 91.9% of businesses had a turnover of less than $2 million, that is a lot of the business landscape in Australia. How do these businesses prepare for their sale, it is not a quick process and takes months to years to get a business ready for sale. What education do these business owners have about exit planning? What price are they willing to pay professionals to assist in the sale.

With such a small percentage of businesses being advertised for sale vs exit rates, its an interesting aspect of the business environment in Australia. Education is key for business owners to ensure they can successfully exit their business. Its worth noting the importance of creating an engaging age if business owners want to get enquiries.

Tags: exit rates abs government selling

About the author

Vanessa Lovie

CEO Bsale Australia

Vanessa is the current manager and CEO of Bsale Australia. Over the past 11 years as a business owner, she understands what it takes to grow a ...